Event Budgeting Handbook: Importance, Challenges, Components, Steps, Example Budget Idea

Planning an event can be both exhilarating and overwhelming. Whether you’re organizing a corporate conference, a charity fundraiser, or a wedding, one of the foundational elements of your event planning process is creating a budget.

What is an Event Budget?

An event budget is a financial plan outlining the estimated income and expenses associated with organizing and executing an event. It serves as a roadmap for allocating resources, managing costs, and ensuring the financial viability of the event.

Essentially, an event budget provides organizers with a clear understanding of the financial implications of their event, allowing them to make informed decisions and effectively plan for success.

Key Components:

The key component of the event budget involves:

- Revenue Projections: This includes estimates of income sources such as ticket sales, sponsorships, donations, and merchandise sales.

- Expenses Breakdown: Organizing expenses into categories like venue rental, catering, marketing, staffing, equipment, permits, and insurance helps in understanding where the money will be spent.

- Contingency Fund: It’s crucial to allocate a portion of the budget for unforeseen expenses or emergencies to ensure flexibility and resilience in case of unexpected challenges.

- Monitoring and Adjustment: Regularly tracking revenue against budgeted amounts allows organizers to identify any discrepancies and make necessary adjustments to stay within financial targets.

Importance of Event Budgeting:

- Ensures Financial Accountability: A well-defined budget serves as a financial roadmap, helping you track expenses and manage resources efficiently.

- Mitigates Risk: By anticipating and allocating funds for potential expenses, you can minimize the risk of overspending or running into financial crises.

- Facilitates Decision-Making: A clear budget empowers you to make informed decisions about resource allocation, vendor selection, and pricing strategies.

- Demonstrates ROI: Effective budgeting allows you to evaluate the return on investment (ROI) of your event, providing valuable insights for future planning and decision-making.

Challenges:

Here we discuss some common challenges that every event planner should face during the budget creation;

Step for Budget creation:

There are 8 steps that an every event planner should follow for the successful and effective event budgeting;

1. Define Your Objectives:

Before diving into the financial nitty-gritty, it’s crucial to clearly define the objectives and goals of your event. Are you aiming to raise funds for a cause? Or perhaps your goal is to educate and inspire attendees. Understanding your objectives will help you prioritize expenses and allocate resources effectively.

2. Determine Your Revenue Sources:

Identify all potential revenue streams for your event. This may include ticket sales, sponsorships, merchandise sales, and donations. Be realistic in your projections and consider market demand, pricing strategies, and historical data if available.

3. Outline Your Expenses:

Create a comprehensive list of all expenses associated with your event. This should encompass venue rental, catering, audiovisual equipment, marketing and promotion, staffing, permits, insurance, and any other relevant costs. Research pricing quotes from vendors and suppliers to ensure accuracy.

4. Categorize Your Expenses:

Organize your expenses into categories to facilitate budget management and analysis. Common categories may include:

- Venue and Facilities

- Food and Beverage

- Marketing and Promotion

- Equipment and Technology

- Personnel and Staffing

- Transportation and Logistics

- Contingency Fund

5. Allocate Funds Wisely:

Once you’ve outlined your expenses, allocate funds to each category based on priority and necessity. Consider factors such as the importance of each expense to achieving your event objectives, industry standards, and any negotiated deals or discounts you may have secured.

6. Build in Contingency:

No matter how meticulously you plan, unexpected costs can arise during the course of your event planning journey. It’s essential to allocate a portion of your budget as a contingency fund to address unforeseen expenses or emergencies. A commonly recommended contingency range is 10% to 20% of the total budget.

7. Monitor and Adjust:

Your event budget is a dynamic document that should be regularly monitored and adjusted as needed. Keep track of your actual expenses and revenue in comparison to your budgeted amounts. Identify any discrepancies and adjust your spending or revenue-generation strategies accordingly to stay within your financial targets.

8. Leverage Technology:

Utilize event management software or budgeting tools to streamline the budgeting process and improve accuracy. These tools can help you track expenses, manage invoices, generate financial reports, and collaborate with team members more efficiently.

9. Negotiate and Seek Sponsorships:

Maximize your budget by negotiating with vendors for favorable pricing or seeking sponsorships from businesses and organizations aligned with your event’s mission or target audience. Sponsorships can provide financial support, in-kind contributions, or marketing assistance, reducing your overall expenses and enhancing the event experience.

10. Evaluate ROI:

After your event concludes, conduct a thorough evaluation of your return on investment (ROI). Compare your actual financial outcomes to your initial budget projections and assess the overall success of your event in meeting its objectives. Use this insight to inform future event planning efforts and continuously improve your budgeting process.

Example Event Budget:

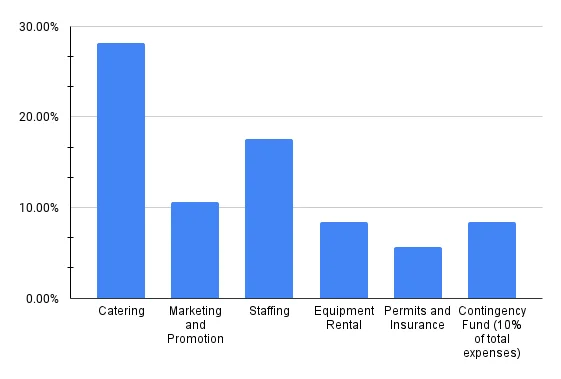

In this example, The event budget breakdown includes various categories such as venue rental, catering, marketing, staffing, equipment rental, permits, insurance, and a contingency fund set at 10% of total expenses, totaling $14,200.

Venue rental secures the event location, while catering covers food expenses. Marketing includes advertising and promotional costs, while staffing involves hiring event personnel. Equipment rental covers AV equipment and furniture, permits ensure legal compliance, and insurance mitigates risks.

The contingency fund addresses unforeseen expenses. This comprehensive approach ensures effective resource management and goal achievement within budget constraints.

Revenue Projections:

| Revenue Source | Estimated Amount ($) |

|---|---|

| Ticket Sales | $10,000 |

| Sponsorships | $5,000 |

| Donations | $2,000 |

| Merchandise Sales | $1,500 |

| Total Revenue | $18,500 |

Expenses Breakdown:

| Expense Category | Estimated Amount ($) |

|---|---|

| Venue Rental | $3,000 |

| Catering | $4,000 |

| Marketing and Promotion | $1,500 |

| Staffing | $2,500 |

| Equipment Rental | $1,200 |

| Permits and Insurance | $800 |

| Contingency Fund (10%) | $1,200 |

| Total Expenses | $14,200 |

Give Away:

Creating an event budget is a foundational step in the event planning process that requires careful consideration and strategic decision-making. With a well-crafted budget in place, you’ll have the confidence and clarity to execute your event vision with precision and effectiveness.